The gig economy, particularly in the e-hailing sector, has seen significant changes and challenges in Malaysia. As the number of service providers increases, they compete fiercely to attract consumers and gain a larger market share. This competitive pressure often comes at the expense of the drivers, whose income continues to decline as companies reduce fares and increase commissions.

One of the major issues facing e-hailing drivers today is the high commission taken by service providers, such as Grab, which takes 20% of the fare for each trip. While this has been the standard, Grab’s new Fare Structure (GSF) complicates the situation further, as it introduces dynamic commissions based on distance and time taken for drivers to reach the pick-up point.

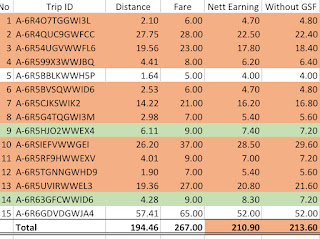

Under the GSF, the service provider claims that the commission will vary depending on how close the driver is to the passenger. If the driver is within five minutes of the pick-up point, Grab will take more than the standard 20% commission. For instance, if a passenger’s fare is RM10, without GSF, Grab would take RM2 as commission, leaving the driver with RM8. However, with GSF, if the driver is just five minutes away, the driver might only receive RM7.70 after commissions. This reduction might seem small, but over many trips, the accumulated loss can significantly impact a driver’s overall earnings.

|

| GSF and Non-GSF Comparison |

What’s more concerning is the structure itself. The fare is now divided into two components: the pick-up fare and the trip fare. While Grab claims that commissions are only taken from the trip fare, which allegedly reduces the overall commission, in practice, the earnings of drivers still suffer. Drivers are expected to bear the brunt of the costs, including fuel, maintenance, and personal expenses, with increasingly diminished earnings.

While the GSF is designed to supposedly protect drivers from long-distance pick-ups by reducing or even waiving the commission if a driver is too far from the pick-up point, it rarely compensates enough for the extra time and fuel spent on such trips. This system seems to favor the service providers at the expense of drivers, who must deal with lower income, high commission rates, and an unpredictable fare structure.

Ultimately, this model demonstrates how e-hailing companies in Malaysia are undermining the public service transport industry by prioritizing their profits over the livelihoods of drivers. The dynamic commission structure appears to be designed to maximize the company’s revenue, with little regard for the drivers who provide the actual service. As competition between service providers grows, it’s the drivers who are left bearing the cost.

In conclusion, the current state of the e-hailing industry is unsustainable for drivers. The increasing competition between service providers, coupled with fare reductions and high commissions, places immense financial pressure on those who rely on these platforms for their livelihoods. If this trend continues, it could result in drivers leaving the industry altogether, further disrupting the public transport system. The balance between consumer affordability and driver welfare needs to be addressed for the industry to remain viable.